Details for Potential Tax Exposure

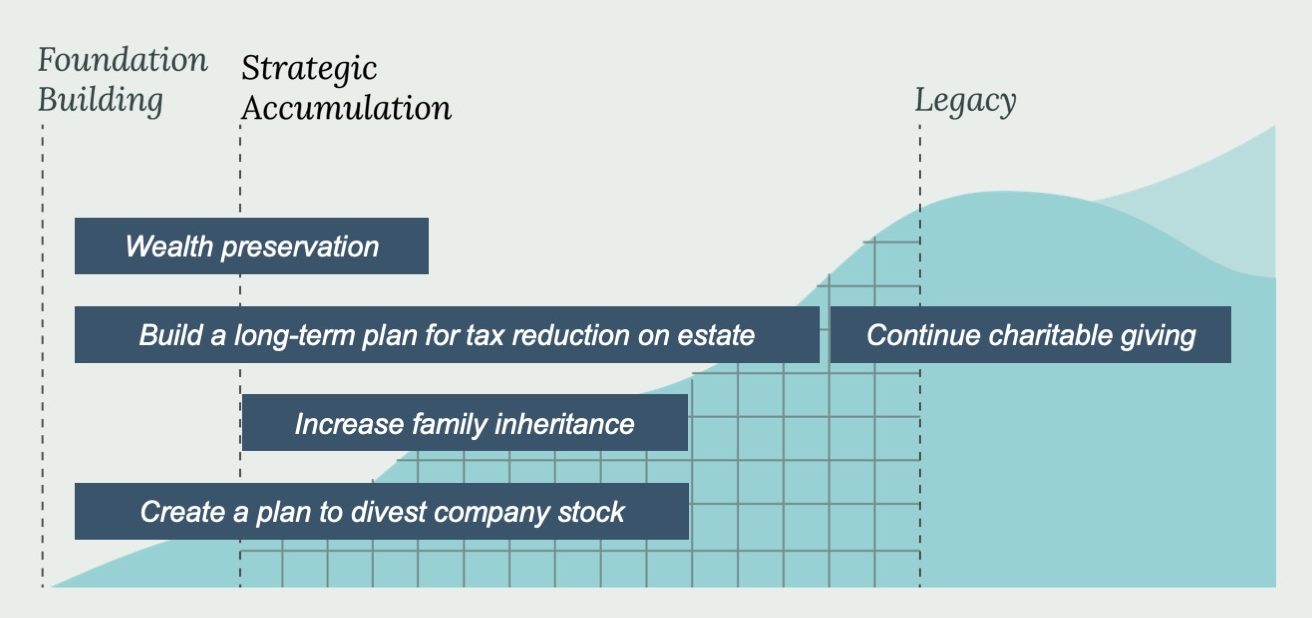

Because a significant amount of their wealth was tied to John’s company stock, tax reduction strategies were essential to estate planning.

Based our projections on investment returns and on current tax law, we estimated that John and Susie would pay approximately $476k in capital gains on the sale of John’s company stock holdings alone. And, their tax total on their entire estate might be upwards of $13 million in combined state, federal, and estate taxes; and that does not even include the annual taxes due on dividends and interest over the next 40 years.

.

With the assistance of a CPA and a tax specialist we implemented a plan to reduce capital gains on the sale of this stock and to increase its value for future philanthropic efforts at the same time – all without impacting the McRae’s income, as they will donate stock to their selected charities at its appreciated value.

And, to protect against unforeseen lawsuits, funds were transferred into creditor protected accounts that would avoid the risk of losses should any future lawsuit arise.