Alterra Advisors for CPAs & Estate Attorneys

As their most trusted advisor, you hold the key to unlock your clients’ wealth potential.

Grow Your Impact as Your Clients’ Go-To Strategist

- RHelp them establish their optimal legacy plan

- RIntegrate their finances with holistic financial plans that align with their goals

- RBring strategy for the continuity of their business

- RCreate unique tax shelters to significantly enhance their wealth preservation

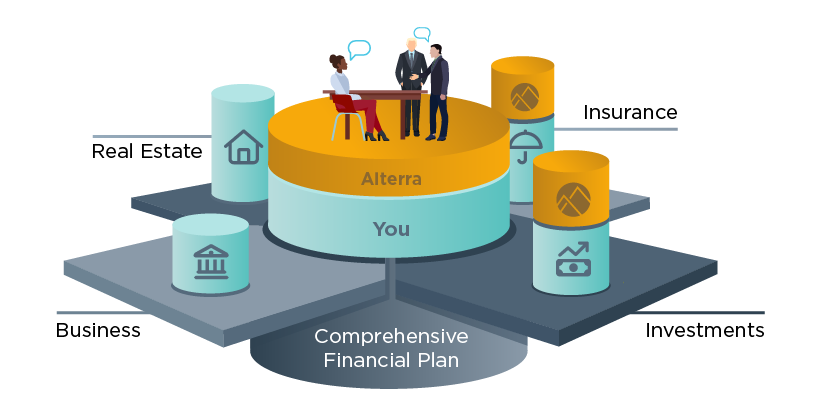

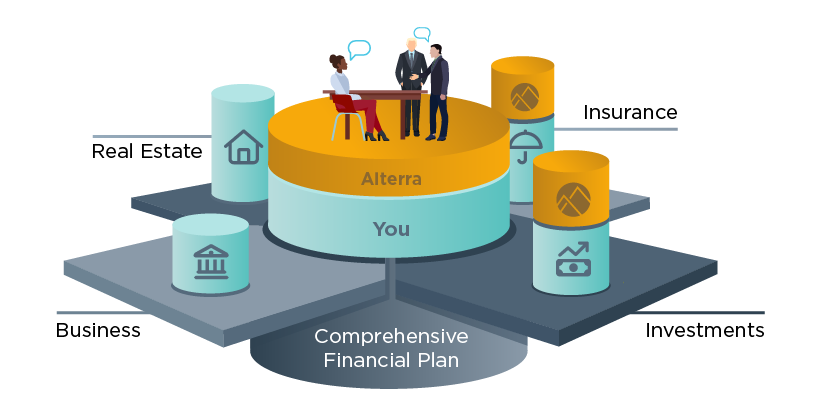

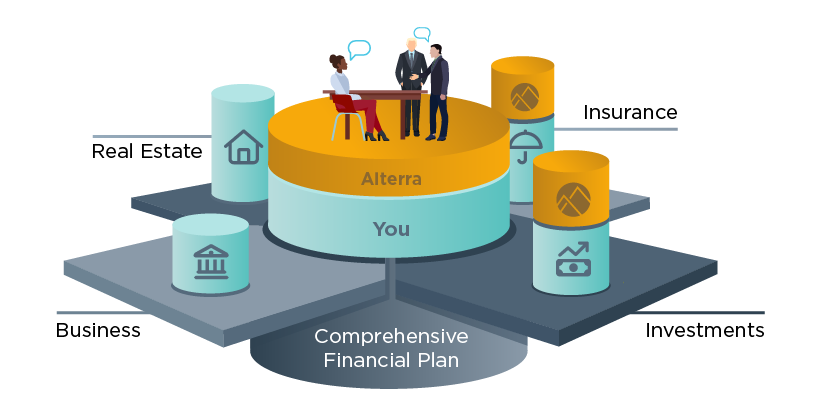

Integrated Financial Planning

Be a part of the most important conversation with your clients—where they want to go, what’s important to them and why. You be the lead, we’ll do the work. Our financial planning process will simplify the complex financial landscape for your clients, enabling them to visualize the impact of various strategies and make informed, confident decisions about their financial future. This clarity fosters a deeper trust and reliance on your services and enhances your role as a pivotal advisor in their financial journey.

Advanced Life Insurance Design—For Business, Tax, and Estate Planning

Offer your clients a unique avenue to preserve their wealth through tax-efficient life insurance solutions that position them for long-term financial growth and legacy planning. Leverage the expertise of Alterra and our nationwide resource, Lion Street, to create an advanced architecture of life insurance for tax, business, and estate planning. From tax-reducing trust strategies, to charitable and premium finance strategies—you have a deep bench of experts at your service. With Alterra by your side, you can foster the most impactful conversations and create the best outcomes to shape your clients’ family legacies.

Business Planning

- Provide business succession planning and buy-sell agreement funding designs to ensure the stability and continuity of your clients’ businesses in unforeseen circumstances, safeguarding their life’s work and providing peace of mind for their families and business partners.

- Offer Executive Compensation Plans to attract and retain top executive talent by designing competitive compensation packages that boost your clients’ business growth and key talent. These plans directly help clients and key team members experience a substantial increase in their net wealth and lifestyle.

- Create unique wealth tax shelters to preserve your clients’ wealth, significantly reducing tax liabilities and maximizing your clients’ financial legacy. The result? More efficient wealth accumulation and protection.

Investment Management

Provide your clients with expertly managed investment portfolios tailored to align with their individual financial goals and risk tolerance. Our professional management helps optimize their investments, ensures a balanced and diversified portfolio, and gives them the confidence that their investments are being handled by knowledgeable experts. As a result, your clients can focus more on their personal and professional lives, secure in the knowledge that their investments are in capable hands.

A Trusted Resource with a deep bench of resources to help you better serve your clients

Gain a competitive edge with the backing of a knowledgeable partner in Alterra. We help you ensure your clients receive top-tier advice and solutions, boosting their satisfaction and trust in your services and ultimately enhancing your value to them. Leverage our deep bench of expertise for sophisticated planning, which includes our firm behind the firm, Lion Street. With us by your side, you will gain access to leading tax strategies, sophisticated life insurance, and wealth planning solutions. Learn more about Lion Street at https://lionstreet.com

Your Collaborative Partner is just a Phone Call Away

We are here to assist you in bringing the best ideas to your clients.

Enjoy the convenience and confidence of prompt assistance and rest assured that you’ll always be equipped with innovative solutions and strategies to exceed your clients’ expectations.

Is Alterra for Advisors for you?

We are a fit for successful Wealth Advisory, CPA, and Estate Planning firms who are:

Driven by a strong commitment to be the best for their clientele and deliver top-notch comprehensive services.

Seeking innovative expertise to differentiate their offerings and elevate their firms in a competitive landscape.

Tired of working with unsophisticated wealth and insurance professionals and wanting to establish an effective partnership.

Ready to scale their business and increase revenues while carving out more personal time for themselves.

See the value of professional collaboration for proactive problem-solving and bringing the best to their clients.

How We Work

As your wealth management specialists, we support you in creating optimal outcomes for your clients.

Fit Review

We meet with you to discuss your client case situation, objectives, problem areas, and what you and your client’s desired outcome is. Then we collaborate on appropriate next steps.

Client Discovery

Together, we meet with your client to listen to their thoughts, understand their objectives, and gather necessary information to help design the planning. Our role is to support the overall plan you have in motion with your client.

Case Design & Review

Our team creates initial plan designs and reviews them with you to collaborate on the ideal action plan to bring to your client.

Plan Education & Overview

Together, we provide your client with education and an overview of the plan in clear, simple language to make it easy for them to see the impact of available options and make a confident decision.

Implementation & Monitor/Review

Once approved, we do all the heavy lifting—meaning we manage the entire process and coordinate everything to put the plan in place. Once the plan is in motion, we’ll be with you every step of the way with ongoing reviews to update the strategy as needed and keep everything on track.

Two Ways to Partner with Alterra

Strategic Partner Model

For the firm who wants to scale their firm’s revenue without adding more hours worked. Our strategic partnerships offer a collaborative fee-sharing model that creates a unified approach and a win-win outcome for you and your clientele.

*Fee collaboration is subject to proper licensing and registration

Trusted Resource Model

For the firm who wants a trusted resource to collaborate with them while preferring to maintain their autonomy in the process. Our Trusted Resource partnerships model enables you to bring more value to your client and ensure critical plan areas are done right.