Case Study: Using a Single Premium Immediate Annuity (SPIA) to Fund Life Insurance and Mitigate Income Tax at Death

The Client

- Mrs. Ira, age 70 with a $8 million net worth, modest lifestyle, and more conservative risk tolerance.

- $2 million IRA account balance not needed to maintain standard of living during life.

- Wants to minimize taxation and maximize the legacy to her children and grandchildren (her IRA Designated Beneficiaries).

The Damage: Greater Taxation of Inherited IRAs

- The SECURE Act eliminated the ability for Designated Beneficiaries (DBs) of Individual Retirement Accounts (IRAs) and Defined Contribution Plans (DCPs) to “stretch” distributions over their life expectancies.

- Such inherited account balances must now be liquidated by DBs within 10 years of the account holder’s death, and may be subject to complex, life expectancy-based distributions annually in years 1-9 if the IRA owner died after required minimum distributions had begun.1

- Future wealth accumulation for DBs may be impaired since distributions may now be accelerated over fewer years, the beneficiary’s taxable income and marginal tax rate may be increased, and tax-deferred growth beyond 10 years is lost.

The Damage Control

IRA Relocation with SPIA and Life Insurance

- Life insurance death benefit proceeds are generally received by the beneficiary income tax free.2

- If the IRA is not needed during life, Mrs. Ira can purchase a SPIA with it, which pays a guaranteed income for her life, use the after-tax payments to fund premiums on a life insurance policy and, thus, “relocate” the IRA value to an income tax-free death benefit.

- Since SPIA payments stop at her death, it may yield more fixed income than traditional assets due to “mortality credits” built into its pricing and, since it has no account balance to transfer, it may reduce or eliminate taxation on the IRA to her beneficiaries.3

- This strategy does not reverse the damage caused by the 10-year rule but can help control it by creating a more tax-efficient legacy, possibly increase amounts passed on to her beneficiaries helping ensure greater financial security.

- The annual RMD complexities in years 1-9 after Mrs. Ira’s post-age 72 death can also be avoided to the extent of this strategy because SPIA payments stop at her death and the life insurance proceeds can be freely invested.4

Projected Results

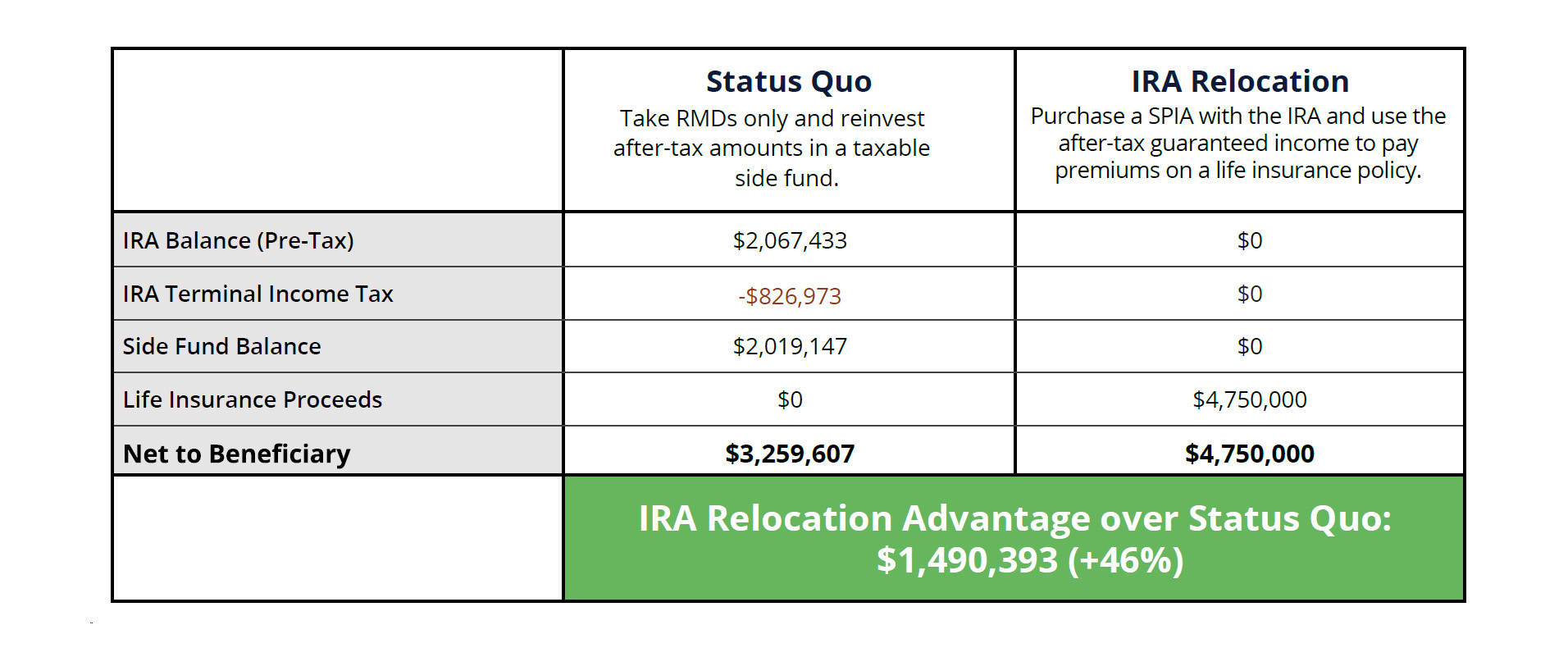

- Status Quo: Take Required Minimum Distributions (RMDs) only and reinvest after-tax amounts in a taxable side fund.

- IRA Relocation: Purchase a SPIA with the IRA and use the after-tax guaranteed income to pay premiums on a life insurance policy.

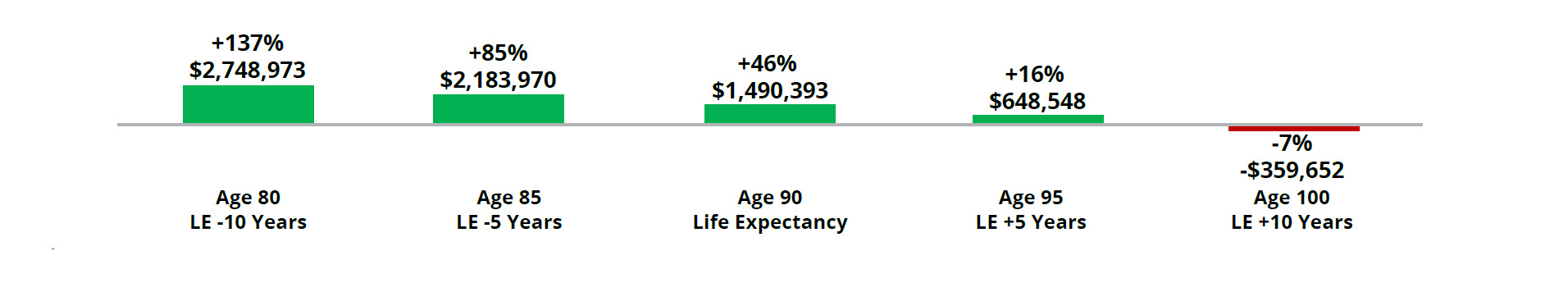

IRA Relocation ADVANTAGE or DISADVANTAGE vs. Status Quo in Wealth Transfer Net of the IRA Terminal Income Tax Liability

Download full analysis here. An example of the calculations above and the assumptions are on page two below.

An example of the calculations assuming Mrs. Ira passes away at her life expectancy, age 90:

Investment assumptions: 5.79% pre-tax rate of return, 0.75% asset management fee (on end of year balance including return), 5% net pre-tax return (IRA assets), 20% average tax rate on side fund, 4% net after-tax return (side fund assets), 32% tax rate on IRA distributions, 40% tax rate on IRA liquidation at death which is meant to simulate the effect of returning to a top federal marginal rate of 39.6% after 2025 under current law and tax bracket jump to the beneficiary due to accelerated liquidation over 10 years.

Life insurance assumptions: Penn Mutual SPIA with a $2,000,000 premium and $161,149 life-only annual payment (8.06% of the premium for life) beginning one month from issue. John Hancock Protection UL 22, $4,750,000 face amount, Option A Level, annual premium of $109,582, which is the after-tax SPIA payment amount using the above tax assumptions. Solved for face amount to carry policy to $1,000 of cash value at age 100 based on non-guaranteed charges and the 4.95% current credited interest rate. Life insurance policy no-lapse guarantee to year 14 (age 84) assuming premiums paid on time when due. Female, age 70, and standard plus nonsmoker. Pricing is as of March 2024.5

- Proposed regulations were released in February 2022 which, if finalized as proposed, would require annual life expectancy method-based RMDs by DBs in years 1-9 after inheriting the IRA if the account owner died after reaching his or her required beginning date for RMDs. For account holders that died on or before 12/31/2019, the pre-SECURE Act rules apply. Eligible Designated Beneficiaries (EDBs) of those who died after 12/31/2019 are excluded from the 10-year rule and remain eligible to stretch the IRA and DCP using the life expectancy method. EDBs include a surviving spouse, minor child (grandchildren are not eligible), disabled individual, or a beneficiary not more than 10 years younger than the account holder. A surviving spouse can still elect to treat the inherited IRA as his or her own (i.e., spousal rollover). Note that upon death of an EDB, or reaching the age of majority, the 10-Year rule would apply.

- Assumes the policy was not transferred for valuable consideration to an impermissible transferee and no other exception to the general rule of IRC § 101(a) applies.

- The account balance used to buy a SPIA is traded for guaranteed income. “Mortality credits” represent the additional amount that can be paid to a group of annuitants in excess of principal and interest that any individual one could generate alone with traditional fixed income assets as a result of the surplus created for the insurance carrier by annuitants in the group who die early and receive less which funds the payments for those who live longer and receive more.

- If SPIA payments continue after her death, such as through a period certain feature, the RMD rules would generally not apply since the IRA was annuitized and a fixed payment schedule would be received by her beneficiary.

- Death benefit payments and guaranteed elements are based on the claims-paying ability of the issuing company. Non-guaranteed elements are subject to change at the issuing company’s discretion. The ability to purchase life insurance, and premiums therefor, depend on financial and medical underwriting requirements.

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.