Case Study: Funding Estate Tax with Discounted Dollars

The Client: Background

- Mrs. Savvy, age 70, is a successful entrepreneur, beginning to “wind down” and in good health.

- Current gross estate of $25,000,000, consisting of $20,000,000 in a closely held business, $2,500,000 in real estate, $1,000,000 in cash/bonds and $1,500,000 in personal residences.

- Current estate tax liability of $5,000,000 which exceeds currently available liquidity.

- Wants to manage any potential estate tax risk and preserve wealth for her heirs.

The Risk: Aligning Liquidity with the Liability

- Estate tax, if applicable, is generally due within nine months of the date of death.1

- The liquidity available from traditional assets may not align with the timing of the estate tax since the timing of death and investment performance is uncertain.

- How can she ensure liquidity is made available to her estate at the right time to pay the tax and for the lowest effective cost?

The Solution

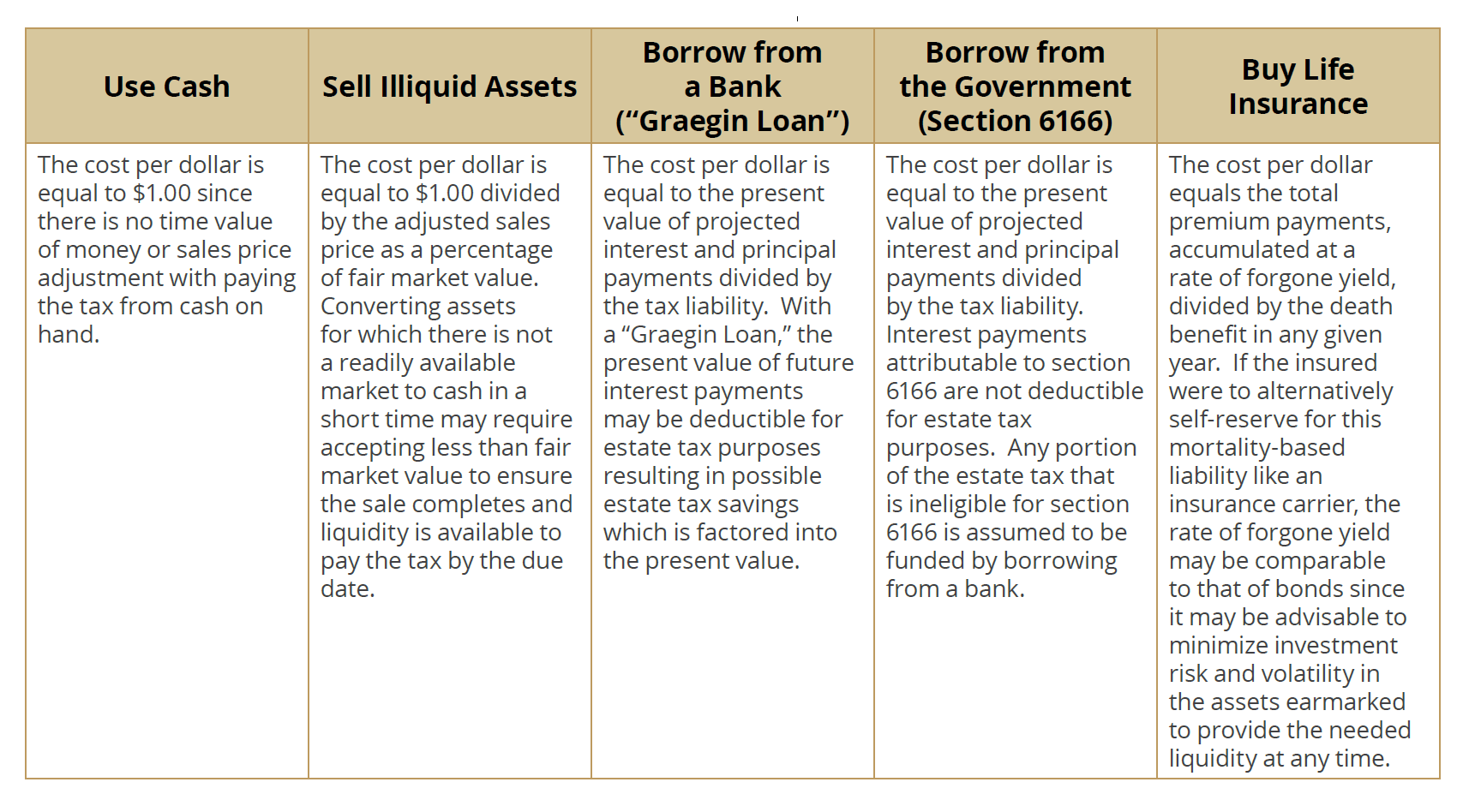

Four Ways to Pay the Estate Tax

- 1. Use Cash—She can hold cash on reserve so her estate has sufficient liquidity to pay the tax at any time regardless of when death occurs.

- 2. Sell Illiquid Assets—Her estate can try to sell illiquid assets within nine months after her death to convert them to cash sufficient to pay the tax.

- 3. Borrow from a Bank (“Graegin Loan”) or the Government (Section 6166)—Her estate can try to get a loan from a bank within nine months after her death to provide the liquidity to pay the tax, with interest and principal paid back over time, the funding of which can come from earnings from estate assets.2 Alternatively, if eligible, her estate can elect to defer the payment of estate tax attributable to the closely held business for four years after the due date, with installment payments of the tax balance due for the next 10 years, and interest payable at prescribe rates along the way, the funding of all of which can come from earnings from her estate assets.3

- 4. Buy Life Insurance—She can buy life insurance to provide liquidity on her death, the timing of which lines up precisely with when the tax liability arises.4

Because the death benefit may far exceed the premiums paid, even considering a rate of forgone yield for many years, life insurance could help fund the estate tax with

“discounted dollars” versus other options!

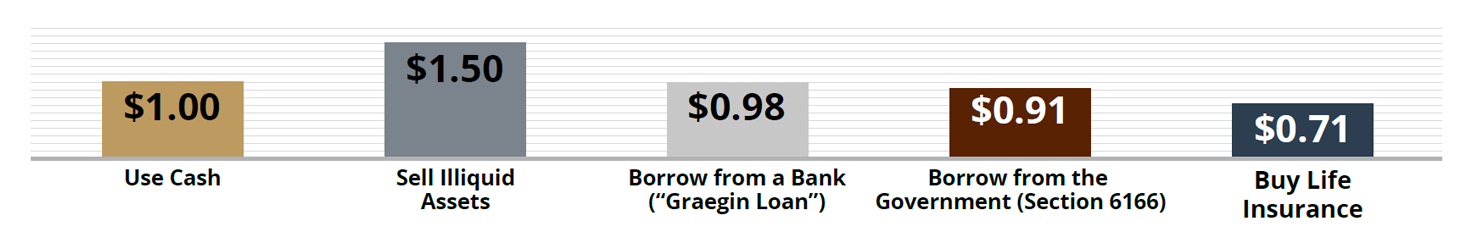

Hypothetical Cost Per Dollar Comparison

An easy way to compare the effective cost of the four options is by calculating their respective “cost per dollar,” which equals the total cost (adjusted for the time value of money) divided by the tax liability (or benefit available to pay the liability).5

Click here to download the full analysis from which the above summary is derived, which includes a more detailed description of the options and summary of the underlying assumptions.

Explanation of ROI Projections

How the Hypothetical Cost Per Dollar is Calculated

For simplicity’s sake, the income, gift and estate tax implications of buying life insurance, or transferring assets, in trust and using the proceeds therefrom to pay an estate tax are beyond the scope of, and not accounted for in, this analysis. Taxpayers should consult a tax and legal professional for essential tax and legal guidance pertaining to their situations.

- Generally, individuals can transfer wealth to someone other than a spouse or charity free of estate and gift tax up to $13,610,000, the lifetime Basic Exclusion Amount (BEA) for 2024. Wealth transferred in excess of this amount could be subject to an estate or gift tax at a rate of 40%. Under current law as of 2024, the BE A will revert to $5,000,000 in 2026 indexed for inflation from 2011, resulting in a BEA in 2026 around $7,200,000-$7,300,000 depending on realized inflation levels through August of 2025.

- Interest expense on debt that is necessarily incurred by an estate to pay estate taxes may be deductible from the gross estate, which can reduce the tax liability, if certain conditions are met. If Proposed Treasury Regulations under § 2053 (REG-130975-08, June 28, 2022) become final, interest expenses to be paid more than three years from death are discounted to a present value from the payment date to the date of death using the mid-term or long-term applicable federal rate (AFR) determined by the length of time from the date of death to the expected payment date.

- § 6166 is available only for estate tax attributable to a closely held business and if the value thereof (or aggregate value of multiple business interests in which the person owned at least 20% of the voting control) exceeds 35% of the person’s adjusted gross estate. The tax balance deferred is subject to daily compounded interest at a rate of 2% on the first $740,000 of eligible estate tax for 2024 and the rest is subject to a rate equal to the § 6621(a)(2) underpayment rate multiplied by 45%, per § 6601(j). § 6234A places a lien in favor of the U.S. government on § 6166 property up to, and generally until repayment of, the deferred amount (plus interest and other amounts payable). Hence, it is conceptually referred to as “borrowing from the government.”

- Buying life insurance requires meeting the carrier’s financial and medical underwriting requirements, and paying the premiums required to carry the policy to the insured’s death. Guarantees are based on the claims-paying ability of the issuing carrier. Death benefit proceeds are generally excludible from the beneficiary’s taxable income. However, this exclusion from income may be limited to the adjusted cost basis in the policy if it is transferred for valuable consideration to an impermissible transferee during the insured’s life.

- Hypothetical assumptions: Sell Illiquid assets assumes a 33% reduced sales price relative to fair market value resulting from a forced sale. Borrow from a Bank assumes a 14-year loan at 6% interest with principal paid in equal installments. The present value of interest payments is deductible for estate tax purposes based on no discount for interest payments in years 1-3 after death and payments in years 4-9 and 10+ discounted at a 4% mid-term AFR and 4.5% long-term AFR, respectively. Borrow from the Government assumes a § 6166 deferral and installment payment of the tax with $740,000 eligible for the 2% rate and the balance subject to a § 6621(a)(2) underpayment rate of 6% times 45%. Any estate tax not eligible for § 6166 is funded via bank loan with the above assumptions. The present value of payments in both “Borrow” scenarios uses a 4% discount rate. Buy Life Insurance assumes a current assumption UL policy for a female, age 70, standard plus nonsmoker risk, $5 million face amount, solve for premiums to carry the policy to age 100 based on non-guaranteed charges and the current credited interest rate. Premiums are accumulated at a forgone yield of 4% after tax and after investment fees.

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.