Case Study: Illustrating the Potential Benefit of Making Annual Gifts to Fund ILIT Policy Premiums

The Client

- Female, age 70, with a $35,000,000 estate expected to appreciate at 2% net of spending needs.

- Has not used any of her $13,610,000 lifetime gift tax exclusion in 2024.

- Four beneficiaries for the purposes of $18,000 per-donee annual gift tax exclusion in 2024.

- Wants to minimize the impact of estate tax to maximize her legacy to her beneficiaries.

The Problem: Provide Liquidity to Mitigate Estate Tax

- Her current federal estate tax liability is almost $9,000,000, which is generally due within nine months of her death.

- If the current law expires, her federal estate tax liability could exceed $12,000,000 in 2026 and $20,000,000 by her life expectancy, depending on appreciation in her estate and inflation adjustments to the exclusion by then.`

- Because this liability is contingent on her death, which is uncertain, her advisor suggested acquiring a $15,000,000 life insurance policy in an ILIT for an annual premium of $346,000 but she is questioning whether it would be a good use of money compared to other investments in her estate.2

The Solution

Acquire Life Insurance in an ILIT

- She forms an ILIT to apply for and own a policy on her life, funded by making annual gifts as the premiums come due.

- Life insurance enjoys favorable, codified tax treatment due to the financial security it helps provide for the general public.

- Death benefit proceeds received by her ILIT are exempt from both income and estate tax, if structured properly.3

- This tax-exempt cash becomes payable upon the same contingency that triggers the timing of her estate tax liability, and can be used to purchase assets from, or make loans to, her estate to provide liquidity to pay the tax by the due date and help ensure financial security for her beneficiaries.

- To match the economic value of the ILIT death benefit proceeds after taxes and fees, an equivalent investment in a taxable asset may require much higher yields and possibly greater risk than the life insurance.

Click here to download the full analysis regarding the above calculations for underlying assumptions and reference information. Policy assumptions: Universal life policy from a highly rated carrier, standard plus nonsmoker risk class, solve for an annual premium to carry coverage to her age 100 at the current, non-guaranteed charges and 4.95% credited interest rate. Cash value is increased by premiums paid and credited interest and reduced by policy charges deducted to pay for the death benefit coverage.

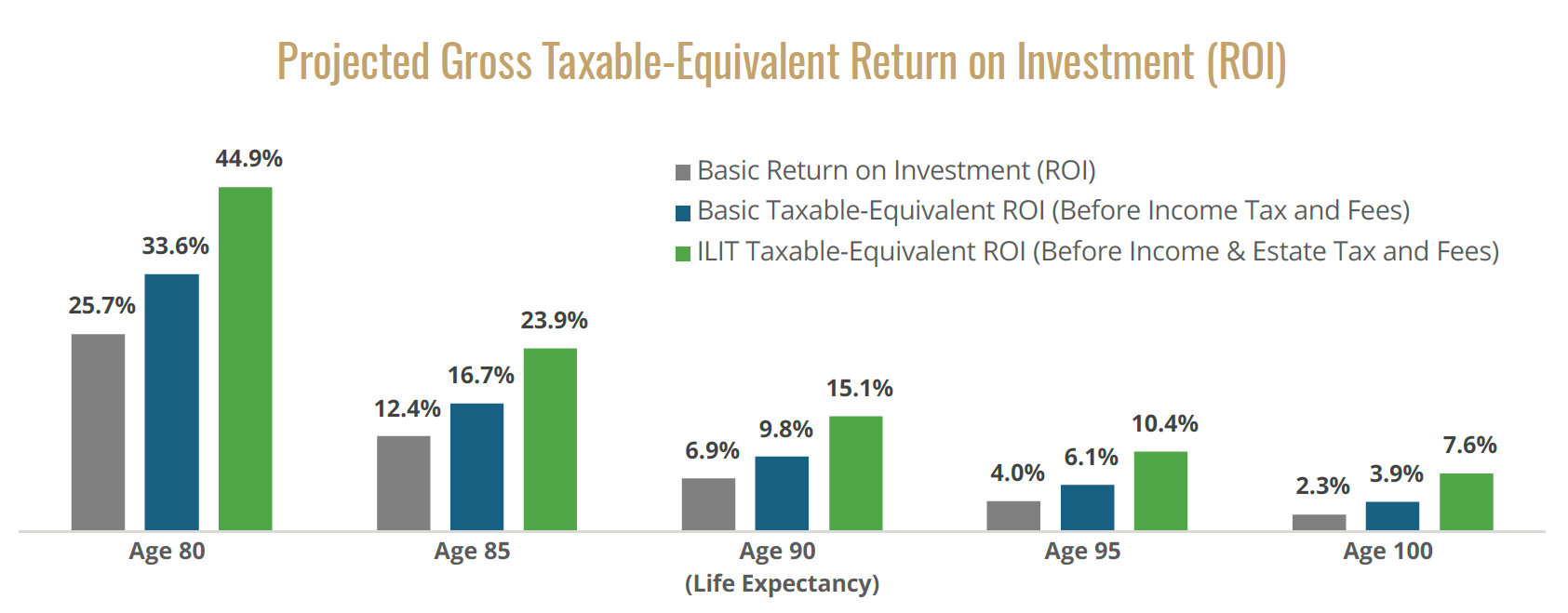

Explanation of ROI Projections

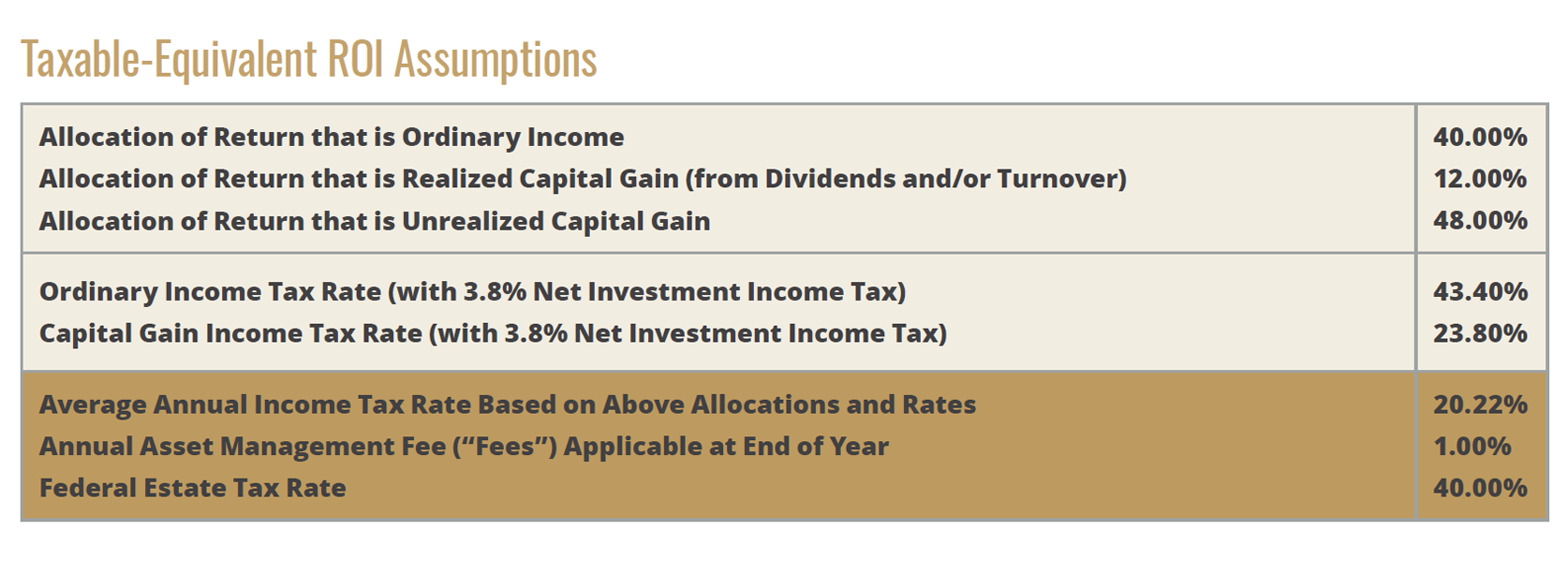

- If she were to die at age 90 (her life expectancy), for example, the annualized basic ROI after all applicable taxes and asset management fees is 6.9% (gray bars).

- However, if the policy outlay were instead invested in a taxable asset subject to income taxes on realized gains and earnings, and asset management fees on year-end values, the annualized gross taxable-equivalent ROI before income taxes and fees that would be needed for the asset to produce the same $15,000,000 of liquidity is 9.8% (blue bars).

- What’s more, if she retained the outlay and invested it inside her taxable estate, the annualized gross taxable-equivalent ROI would jump to 15.1% for there to be $15,000,000 of liquidity available to her beneficiaries by her age 90 after income taxes and asset management fees each year and estate taxes at her death (green bars).

The ability to acquire life insurance depends on meeting the issuing carrier’s financial and medical underwriting requirements. Any non-guaranteed policy elements are subject to change at the carrier’s discretion and can impact the actual performance of the policy’s cash value and premiums required to carry the coverage to maturity. Guarantees are based on the financial strength of the issuing carrier.

- Estate tax estimates assume her current estate projected at 2% growth per year, an inflation rate of 2% per year and she makes no adjusted taxable gifts during life to which her lifetime basic exclusion amount (BEA) is allocated. The Tax Cuts and Jobs Act of 2017 (“The Act”) doubled the BEA per donor for gift and estate taxes from $5,000,000 to $10,000,000 (adjusted for inflation). The BEA is the maximum amount of aggregate transfers that a donor can make during life and at death without paying gift or estate tax on the transfers. For 2024, the inflation-adjusted BEA is $13,610,000 per donor. However, the provision of The Act was temporary and expires after 2025 at which point the exclusion revert to $5,000,000 (adjusted for inflation) under current law. Depending on inflation results through August 2025 when the adjusted amounts are declared for the following year, the 2026 BEA may end up in the range of $7,200,000 to $7,400,000 assuming no new legislation is enacted prior.

- Premiums may need to be adjusted up or down from originally illustrated to carry the policy to maturity based on changes to credited interest rates and/or cost of insurance charge rates. Changes to the latter have been less common, historically, but past results are not a guarantee for future performance. Thus, actual performance may be better or worse than illustrated.

- For the death benefit payable to the ILIT to be exempt from income tax, the policy cannot have been transferred for valuable consideration to an impermissible transferee nor in a transaction treated as a reportable policy sale under Internal Revenue Code (IRC) section 101(a). For it to be exempt from estate tax, the insured cannot have possessed any incidents of ownership in the policy within three years of death under IRC section 2042.

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.