Staying the Course: How Time Turns Volatility into Growth

If you’ve been a long-term investor, you’ve likely experienced the ups and downs that come with the territory. The phrase, “stay the course” is something you’ve liked heard countless times. Markets rise, they fall, and over the years, patterns emerge. Yet even with that experience, it’s still easy to feel unsettled when things move unpredictably.

That’s because volatility feels like risk even when it isn’t putting your future in jeopardy.

But when you take a step back and view your plan in the context of time, you start to see it differently. Volatility isn’t the problem. A lack of clarity is. And that’s something a well-structured plan is built to solve.

Let’s Look at the Data

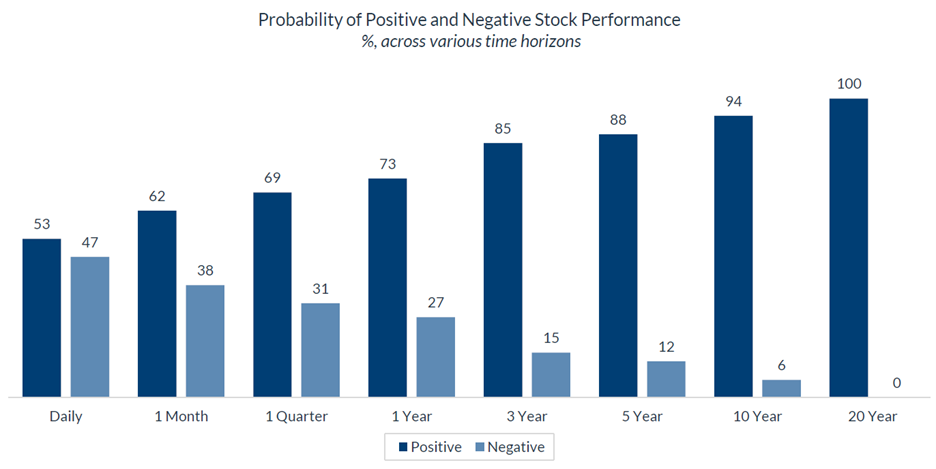

A recent study from City National Rochdale revealed a powerful truth: the longer you stay invested, the lower your chances of experiencing negative returns.

Their research, based on nearly 100 years of S&P 500 performance, shows:

- 1-Day Investors: 53% chance of a positive return

- 1-Year Investors: 73% chance

- 5-Year Investors: 88% chance

- 10-Year Investors: 94% chance

- 20-Year Investors: 100% of time periods were positive

That’s not a typo—not a single 20-year period in nearly a century has resulted in a net loss.

So, What Does That Mean for You?

- Don’t confuse volatility with permanent loss. It’s normal for markets to rise and fall in the short term. But if your income plan is sound, those swings shouldn’t touch your lifestyle.

- Match your money to your timeline. The funds you’ll need in the next few years should be in more stable investments. Everything else? It’s your long-term engine for growth.

- Stick to the plan, especially when it’s tempting not to. This is exactly why we created your strategy—to make good decisions easy, even when emotions are running high.

Peace of Mind Comes from Planning, Not Prediction

You can’t predict what the market will do tomorrow, next week, or even next year. But you can build a plan that makes you confident no matter what it does.

That’s the difference between reacting to the moment and being grounded in a long-term strategy.

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.